RR Phantom

Location : Wasted Space

Job/hobbies : Cayman Islands Actuary

|  Subject: The Bitcoin Boom: Asset, Currency, Commodity or Collectible? Subject: The Bitcoin Boom: Asset, Currency, Commodity or Collectible?  Wed Oct 27, 2021 7:37 pm Wed Oct 27, 2021 7:37 pm | |

| As I have noted with my earlier posts on crypto currencies, in general, and bitcoin, in particular, I find myself disagreeing with both its most virulent critics and its strongest proponents. Unlike Jamie Dimon, I don't believe that bitcoin is a fraud and that people who are "stupid enough to buy it" will pay a price for that stupidity. Unlike its biggest cheerleaders, I don't believe that crypto currencies are now or ever will be an asset class or that these currencies can change fundamental truths about risk, investing and management. The reason for the divide, though, is that the two sides seem to disagree fundamentally on what bitcoin is, and at the risk of raising hackles all the way around, I will argue that bitcoin is not an asset, but a currency, and as such, you cannot value it or invest in it. You can only price it and trade it.

Assets, Commodities, Currencies and Collectibles

Not everything can be valued, but almost everything can be priced. To understand the distinction between value and price, let me start by positing that every investment that I will look at has to fall into one of the following four groupings:

Cash Generating Asset: An asset generates or is expected to generate cash flows in the future. A business that you own is definitely an asset, as is a claim on the cash flows on that business. Those claims can be either contractually set (bonds or debt), residual (equity or stock) or even contingent (options). What assets share in common is that these cash flows can be valued, and assets with high cash flows and less risk should be valued more than assets with lower cash flows and more risk. At the same time, assets can also be priced, relative to each other, by scaling the price that you pay to a common metric. With stocks, this takes the form of comparing pricing multiples (PE ratio, EV/EBITDA, Price to Book or Value/Sales) across similar companies to form pricing judgments of which stocks are cheap and which ones are expensive.

Commodity: A commodity derives its value from its use as raw material to meet a fundamental need, whether it be energy, food or shelter. While that value can be estimated by looking at the demand for and supply of the commodity, there are long lag and lead times in both that make that valuation process much more difficult than for an asset. Consequently, commodities tend to be priced, often relative to their own history, with normalized oil, coal wheat or iron ore prices being computed by averaging prices across long cycles.

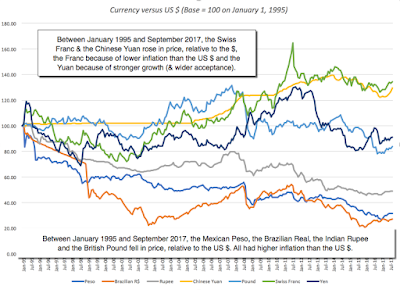

Currency: A currency is a medium of exchange that you use to denominate cash flows and is a store of purchasing power, if you choose to not invest. Standing alone, currencies have no cash flows and cannot be valued, but they can be priced against other currencies. In the long term, currencies that are accepted more widely as a medium of exchange and that hold their purchasing power better over time should see their prices rise, relative to currencies that don't have those characteristics. In the short term, though, other forces including governments trying to manipulate exchange rates can dominate. Using a more conventional currency example, you can see this in a graph of the US $ against seven fiat currencies, where over the long term (1995-2017), you can see the Swiss Franc and the Chinese Yuan increasing in price, relative to the $, and the Mexican Peso, Brazilian Real, Indian Rupee and British Pound, dropping in price, again relative to the $.

Collectible: A collectible has no cash flows and is not a medium of exchange but it can sometimes have aesthetic value (as is the case with a master painting or a sculpture) or an emotional attachment (a baseball card or team jersey). A collectible cannot be valued since it too generates no cash flows but it can be priced, based upon how other people perceive its desirability and the scarcity of the collectible.

Viewed through this prism, Gold is clearly not a cash flow generating asset, but is it a commodity? Since gold's value has little to do with its utilitarian functions and more to do with its longstanding function as a store of value, especially during crises or when you lose faith in paper currencies, it is more currency than commodity. Real estate is an asset, even if it takes the form of a personal home, because you would have had to pay rental expenses (a cash flow), in its absence. Private equity and hedge funds are forms of investing in assets, currencies, commodities or collectibles, and are not separate asset classes.

.https://aswathdamodaran.blogspot.com/2017/10/the-bitcoin-boom-asset-currency.html?fbclid=IwAR1yy19v6bqDS-ySvwga-BFi0f1DmATN-ev6-7X0dWrAxxvnOZD3b9BZcLU

_________________

Anarcho Capitalists Retail , OZschwitz Downunder BoutiqueAnarcho-Capitalists,AnCaps Forum,Anti-State,Anti-Statist,Inalienable Rights Defenders,Non-Aggression Principle,Non-Initiation of Force Principle,Rothbardians,Anarchist,Capitalist,objectivism,Ayn Rand,Anarcho-Capitalism,Anarcho-Capitalist,politics,libertarianism,Ancap Forum,Anarchist Forum,Vulgar Libertarians,Hippies of The Right,Forum for Anarcho-Capitalist,Forum for Anarcho-Capitalists,Forum for AnCap,Forum for AnCaps,Libertarian,Anarcho-Objectivist,Freedom, Laissez Faire, Free Trade, Black Market, Randroid, Randroids, Rothbardian, AynArchist, Anarcho-Capitalist Forum, Anarchism, Anarchy, Free Market Anarchism, Free Market Anarchy, Market Anarchy

|

|