CovOps

Location : Ether-Sphere Location : Ether-Sphere

Job/hobbies : Irrationality Exterminator

Humor : Über Serious

|  Subject: Investors Rethink Role of Bonds, Tech and ESG After Chaotic Year Subject: Investors Rethink Role of Bonds, Tech and ESG After Chaotic Year  Sat Dec 26, 2020 3:58 am Sat Dec 26, 2020 3:58 am | |

| Mantra of ‘don’t fight the Fed’ held true during the pandemic

Performance of ESG-related stocks proved skeptics wrong

This has been a year like no other.

Hammered by an unprecedented health crisis, global stocks tumbled into a bear market at record speed, and then rallied to new highs thanks to a flood of central bank money. Bond yields tanked to uncharted lows and the world’s reserve currency surged to all-time highs, only to then retreat to its weakest level in more than two years as 2020 draws to a close.

Global asset allocators from BlackRock Inc. to JPMorgan Asset Management have outlined their takeaways for investors from the volatile year. Here are some of their reflections:

Rethink Bonds’ Role in Portfolios

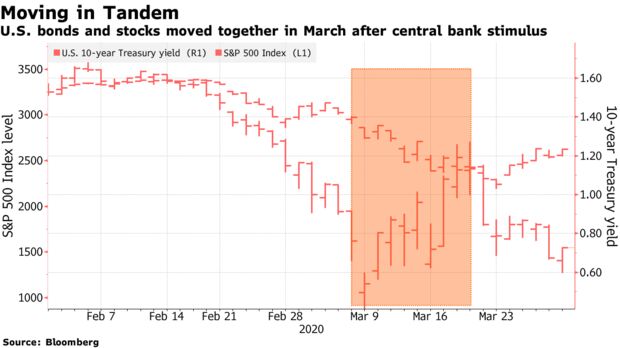

The massive stimulus doled out by global policy makers when markets seized up in March led to one instance of a breakdown in what has long been a negative correlation between equities and bonds. The 10-year U.S. Treasury yield rose from 0.3% to 1% within a week, and simultaneously equity markets continued to fall.

Now, as investors face lower-for-longer rates even as growth picks up, doubts are emerging whether developed-market government bonds can continue to provide both protection and diversification as well as satiate investors seeking income gains. There’s also a debate over the traditional investing policy of putting 60% of funds in stocks and 40% in bonds, even though the strategy proved to be resilient during the year.

“We expect more active fiscal stimulus than any other modern period in history in the next economic cycle, as monetary and fiscal policy align,” said Peter Malone, portfolio manager at JPMorgan Asset’s multi-asset solutions team in London. “Future returns from a simple, static stock-bond portfolio will likely be constrained.”

Some Wall Street giants recommend investors take a pro-risk stance to adapt to the changing role of bonds. Among them, BlackRock Investment Institute advised investors to turn to equities and high-yield bonds, according to a note published in early December.

‘Don’t Fight the Fed’

Few would have expected the swift turnaround in markets we saw in 2020. As Covid-19 spread, the S&P 500 Index plunged 30% in just four weeks early in the year, a much faster tumble than the median one-and-a-half-years it had taken it to get to the bottom in previous bear markets.

Then, as governments and central banks shored up economies with liquidity, stock prices rebounded at an equally astonishing pace. In about two weeks, the U.S. benchmark was up 20% from its March 23 low.

“Normally you get more time to position your portfolio in a correction,” said Mumbai-based Mahesh Patil, co-chief investment officer at Aditya Birla Sun Life AMC Ltd.. With markets moving so fast, someone in cash “would have been caught napping on this rally and it would have been difficult to catch up.”

Being a bit contrarian helps, Patil said, adding that it’s better for investors not to take too large a call on sitting on cash. They should also focus on a bottom-up portfolio so they can go through both up and down cycles, he said.

SooHai Lim, head of Asia Equities ex-China at Barings, said the speedy market recovery proved the soundness of the old saying “Don’t fight the Fed.”

That said, some fund managers warned that investors should not take swift central banks support as guaranteed.

“It was a flip of a coin where it went from there and whether they’d stepped in early enough,” said John Roe, head of multi-asset funds at Legal & General Investment Management in London. “The downside could have been unprecedented.”

.https://www.bloomberg.com/news/articles/2020-12-26/investors-rethink-role-of-bonds-tech-and-esg-after-chaotic-year.

_________________

Anarcho-Capitalist, AnCaps Forum, Ancapolis, OZschwitz Contraband

“The state calls its own violence law, but that of the individual, crime.”-- Max Stirner

"Remember: Evil exists because good men don't kill the government officials committing it." -- Kurt Hofmann |

|