RR Phantom

Location : Wasted Space

Job/hobbies : Cayman Islands Actuary

|  Subject: Confirmed: Fed Bailed Out Hedge Funds Facing Basis Trade Disaster Subject: Confirmed: Fed Bailed Out Hedge Funds Facing Basis Trade Disaster  Sat Mar 21, 2020 5:00 pm Sat Mar 21, 2020 5:00 pm | |

| Back in December, when the world was still confused about what exactly happened before (and after) the September repocalypse - which has since exploded thousand-fold resulting in the Fed now doing daily $1 Trillion repo operations - we said that in addition to the implicit bailout of JPM (which we described here first, and subsequently others), by restarting its repo operations the Fed was also bailing out dozens of hedge funds engaging in highly levered trades involving a relative value compression trade in the Treasury cash/swap basis... almost identical to what LTCM was doing ahead of its 1998 bailout, which is also why we titled the article "The Fed Was Suddenly Facing Multiple LTCMs."

In a nutshell, the article explained why and how the return of the Fed's repo ops was nothing more than the Fed preemptively bailing out all those hedge funds that would have imploded had basis trades gone haywire. Below is a key excerpt from that post:

- Quote :

- One increasingly popular hedge fund strategy involves buying US Treasuries while selling equivalent derivatives contracts, such as interest rate futures, and pocketing the arb, or difference in price between the two. While on its own this trade is not very profitable, given the close relationship in price between the two sides of the trade. But as LTCM knows too well, that's what leverage is for. Lots and lots and lots of leverage.

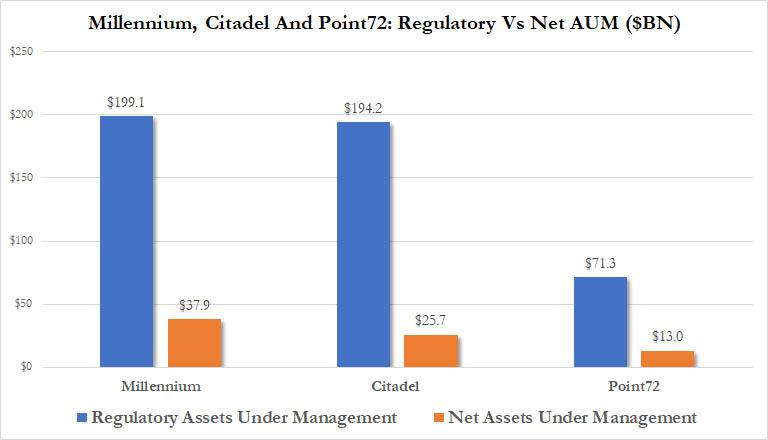

We also said that "hedge funds such as Millennium, Citadel and Point 72 are not only active in the repo market, they are also the most heavily leveraged multi-strat funds in the world, taking something like $20-$30 billion in net AUM and levering it up to $200 billion. They achieve said leverage using repo."

https://www.zerohedge.com/markets/confirmed-fed-bailed-out-hedge-funds-facing-basis-trade-disaster?fbclid=IwAR1IYlLnJiOR_ZnG7Wvoum8G_Ee0Beqq20qBcbRNb6iqqoq8C3u4qMaupaY |

|

CovOps

Location : Ether-Sphere Location : Ether-Sphere

Job/hobbies : Irrationality Exterminator

Humor : Über Serious

|  Subject: Re: Confirmed: Fed Bailed Out Hedge Funds Facing Basis Trade Disaster Subject: Re: Confirmed: Fed Bailed Out Hedge Funds Facing Basis Trade Disaster  Sat Mar 21, 2020 8:14 pm Sat Mar 21, 2020 8:14 pm | |

|  |

|