CovOps

Location : Ether-Sphere Location : Ether-Sphere

Job/hobbies : Irrationality Exterminator

Humor : Über Serious

|  Subject: Tiny Price Gaps Cost Investors Billions Subject: Tiny Price Gaps Cost Investors Billions  Fri Jan 24, 2020 12:44 am Fri Jan 24, 2020 12:44 am | |

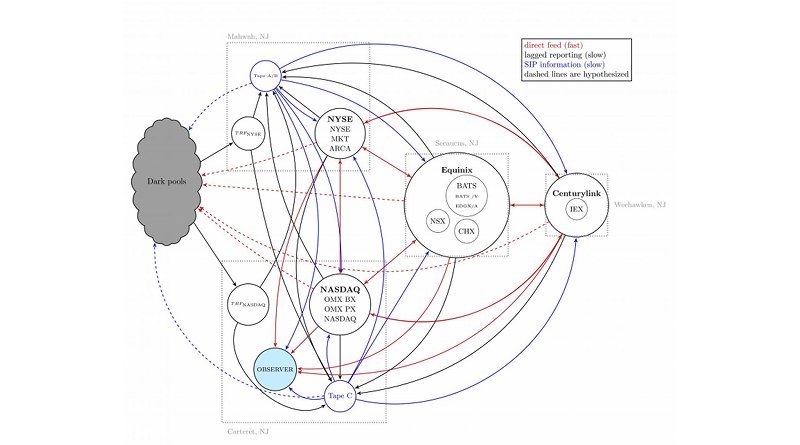

| Looking a bit like a bowl of spaghetti, this map shows the general scheme of the US stock market -- formally known as the National Market System -- as described by a team of scientist at the University of Vermont and The MITRE Corporation. Spread out between four communities in northern New Jersey, and with many back-and-forth flows of information, some faster than others, this complex system has contributed to some investors seeing prices earlier than other investors.

Imagine standing in the grocery store, looking at a pile of bananas. On your side of the pile, the manager has posted yesterday’s newspaper flyer, showing bananas at 62¢ per pound–so that’s what you pay at the register. But on the other side of the pile, there’s an up-to-the-minute screen showing that the price of bananas has now dropped to 48¢ per pound–so that’s what the guy over there pays. Exact same bananas, but the price you see depends on which aisle you’re standing in.

New research from the University of Vermont and The MITRE Corporation shows that a similar situation–that the scientists call an “opportunity cost due to information asymmetry”–appears to be happening in the U.S. stock market.

And, the research shows, it’s costing investors at least two billion dollars each year.

The first of three studies, “Fragmentation and inefficiencies in the US equity markets: Evidence from the Dow 30,” was published in the open-access journal PLOS ONE.

More: https://www.eurasiareview.com/24012020-tiny-price-gaps-cost-investors-billions/

_________________

Anarcho-Capitalist, AnCaps Forum, Ancapolis, OZschwitz Contraband

“The state calls its own violence law, but that of the individual, crime.”-- Max Stirner

"Remember: Evil exists because good men don't kill the government officials committing it." -- Kurt Hofmann |

|