CovOps

Location : Ether-Sphere Location : Ether-Sphere

Job/hobbies : Irrationality Exterminator

Humor : Über Serious

|  Subject: Via Anarcho-Capitalists' Forum: How To Get Bitcoin In Your Stock Portfolio Subject: Via Anarcho-Capitalists' Forum: How To Get Bitcoin In Your Stock Portfolio  Fri Dec 22, 2017 4:56 am Fri Dec 22, 2017 4:56 am | |

| 2017 has undoubtedly been the year of bitcoin, breaking $1000 dollars on New Year’s Day before rocketing up to $15000 in early December. That’s a return of 1,500 percent!

And as market fascination grows, investors are beginning to understand the real secret behind bitcoin’s success – the blockchain.

Blockchain is transforming markets with bitcoin, but that is only the beginning - it could soon change the world.

To understand how, you must first understand that blockchain is a technological platform – and there are nearly no limits to what you can build on it.

Where we used to have hard currencies, we’ll now have cryptocurrencies like bitcoin, using blockchain technology.

Where we used to have asset exchanges, we now have cryptocurrency exchanges like Binance.

Where we used to have Microsoft Windows, blockchain has been used to create an entirely new platform. You may have heard of it: Ethereum. It rose 5,415 percent in 2017.

Put simply, blockchain is the technology upon which future networks will be built – and unlike our current systems, investors can gain partial ownership of these networks and reap the financial rewards!

Bitcoin may have risen 1500 percent this year, but it still only makes up $280 billion of the total $90 trillion of money that exists. A measly 0.3 percent of money, and that’s before considering the $544 trillion derivative markets.

Binance is one of the fastest growing blockchain based exchanges in the world with a market cap of $280 million – and investors holding Binance Coin are receiving financial reward as the exchange grows. Can you imagine the New York Stock Exchange handing you part of its $21 trillion market cap?

Ethereum has risen from $8 to $460 in 2017, and was used for the first time this year to buy a house via its smart contract technology. It is an operating system for blockchain, and while Microsoft Windows is the operating system for 80 percent of laptops and desktops in the world – investors won’t see a cent of that revenue.

These are just three examples out of hundreds that show how you can own a piece of this technological revolution, but the difficulty facing many investors is how to gain exposure... and profit from the blockchain.

The answer to that question? Global Blockchain Technologies Corp. (TSX: BLOC.V; OTC: BLKCF) This ground-breaking company is aiming to become the world’s first publicly traded stock that invests in top-tier blockchain and digital currency innovations. Giving investors exposure to the a cross-section of the blockchain ecosystem.

Here are 5 reasons to keep a close eye on Global Blockchain (TSX: BLOC.V; OTC: BLKCF).

#1 Only Company That Plans to Have Exposure to a Wide Cross-Section of The Blockchain Ecosystem

Global Blockchain is responding to enormous investor demand with its plans to invest in a basket of holdings within the Blockchain space. This strategy will make it the first global investment company with exposure to a broad cross-section of the Blockchain ecosystem, removing the risk associated with purchasing individual coins.

You can buy Global Blockchain Technologies Corp. (TSX: BLOC.V; OTC: BLKCF) right now from an online broker, and even add it to your IRA or 401K.

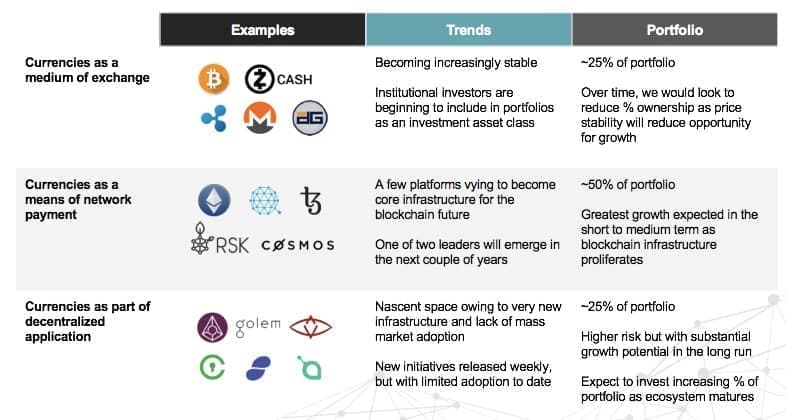

If Global Blockchain carries out its plans, it will be balancing large cap companies with specifically chosen high-growth potential small-caps. Blockchain Global also plans to diversify portfolios by balancing cryptocurrencies by category: here are their planned investments:

(Click to enlarge)

But this is far more than a basket of currencies to speculate on. It’s a technology company with significant potential, planning to build an investment portfolio based on the token economy. And as far as we know, there may be nothing else out there like it.

This is an opportunity for investors to go beyond simply holding cryptocurrencies. The Global Blockchain business model is about investing in various protocols.

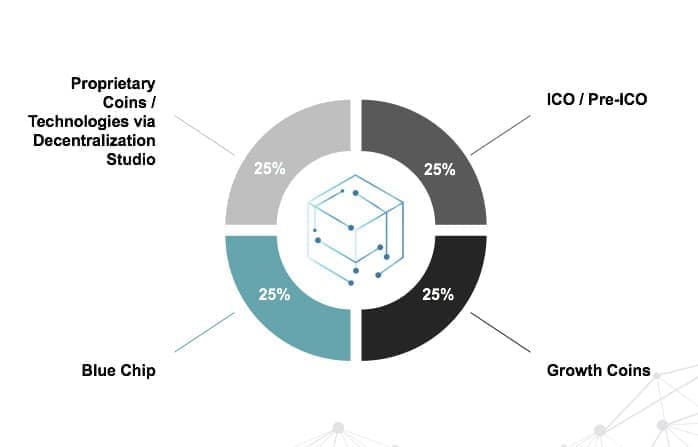

This is about smart asset allocation that has the potential to transform the entire space for investors. And the asset allocation has been clearly set out by this Global Blockchain:

(Click to enlarge)

#2 Blockchain Could Disrupt Everything

As we alluded to earlier, blockchain could well be one of the biggest technologies of our age. It represents automation and collaboration on a new level and incentivizes investors to hold tokens! The growth predictions here may some day be headed into trillion-dollar territory, with investment opportunities the likes of which have never been seen before in history.

After all, blockchain technology is the backbone of the cryptocurrency market, worth about $375 billion and growing at an astounding rate.

The list of industries that could be disrupted by this technology is only limited by your imagination.

• Banking: blockchain and cryptocurrency solve a ton of problems with the $134-trillion global banking industry. Blockchain solves everything from fees for sending payments through middlemen, privacy threats and security risks to cumbersome lending. That’s why seven major global banks have just partnered with fintech companies to develop new blockchain technology.

• Blockchain technology is already being used to track global trade and shipments in this $8-trillion-plus industry.

• The $7.4-trillion real estate industry is also a major beneficiary of blockchain tech. Real estate wonderland Dubai is even putting its entire land registry on a blockchain.

• The global healthcare IT market —a market valued at $134 billion last year – is seeking an IT cure from Blockchain.

• Even the $96-billion crowdfunding market is embracing Blockchain.

And the list goes on …

“Blockchain solutions in finance are virtually endless, and the gaming industry, too, will be massive. But the verticals here are astounding. Imagine creating a protocol for diamond trading, or renewable energy credits,” says BLOC Chairman Steve Nerayoff. “Any centralized market place that is dominated by a few middle men is likely to be taken over by blockchain technology. Anything you can think of where the marketplace can become more democratic.”

Renewable energy is one obvious example of this. If renewable energy credits are created in the Middle East, and someone in China is looking to offset their carbon footprint and buy clean electricity, they would be able to buy these renewable energy credits over the blockchain. To process this transaction without blockchain, the cost of middle man fees and accounting would make it prohibitively expensive and incredibly slow. Blockchain would make these credits instantly available.

The opportunities are mind-boggling, but the investment space can be a dangerous one if you don’t know what you’re doing. That’s where having professionals who understand the space is important...

#3 Top Crypto Pioneers Lead This Innovation

The team behind Global Blockchain (TSX: BLOC.V; OTC: BLKCF) provides investors with an unparraelled level of knowledge and experience in the space. We have identified the space, now it is all about reducing the risk.

Remember the Ethereum ICO? It’s risen over 137,100 percent. Global Blockchain’s Chairman and CEO, Steve Nerayoff was not only the senior advisor to Ethereum in the time leading to its ICO, but was the architect of the Ethereum crowsdale, the way the project was funded. He also was a senior advisor to the Lisk Cryptocurrency project, which now has a $913-million market cap. Nerayoff is an early leader of the blockchain industry, and one of its most important pioneers.

But Global Blockchain’s team doesn’t end with Nerayoff.

• Rik Willard, is another cryptocurrency and ICO veteran, the co-founder of the Silicon Valley Blockchain Society and an advisor to Luxembourg and other countries’ Blockchain initiatives.

• Shidan Gouran is also a cryptocurrency and ICO expert with a long track record.

• Kyle Kemper is the executive director of the Blockchain Association of Canada.

• Jeff Pulver on the Advisory Board has consulted and invested in 350 startups.

• Michael Terpin on the Advisory Board is the co-founder of BitAngels, the world’s first angel network for digital currency startups. He’s also the managing partner of bCommerce Labs, the first Blockchain incubator fund in the world. He founded Marketwire, one of the largest company newswires, which was acquired in 2006 by NASDAQ for $200 million.

And it’s not just their blockchain successes and expertise that investors will be harnessing: It’s their exclusive access to assets that even crypto investors would have limited access to otherwise.

#4 Smart Crypto Balancing Act

2018 could be an even bigger year for blockchain investors...

If the U.S. Securities and Exchange Commission (SEC) approves crypto ETFs, the value of digital currencies could go even higher, with some analysts predicting that as much as $300 million could pour into a bitcoin ETF in its first week.

Europe also has a Bitcoin exchange traded note (ETN) for investors, and analysts are widely expecting the SEC to approve a Bitcoin ETF soon.

And as hype around blockchain and bitcoin continues to increase, CBOE, CME and NASDAQ are all preparing to launch bitcoin futures. While opinion may be split over whether this will be good or bad for the price of bitcoin, it is undeniably a huge step towards the blockchain being integrated into financial markets.

In the meantime, we’re looking at a total market cap of tokens of over $19 billion, and already more than $2 billion has flowed into ICO (initial coin offering) token sales.

Global Blockchain (TSX: BLOC.V; OTC: BLKCF) may have come into play at the right time.

This team knows blockchain and cryptocurrencies. This team has the experience to make the best decisions on which ICOs have what it takes to be winners; and which are likely to fail. And they intend to balance large-cap holdings with small-cap and emerging cryptocurrencies so investors can benefit from the stability of one, and the growth potential of the other at the same time.

But the upside doesn’t stop here for BLOC, it is also set to become an incubator for new crypto technologies, which means that investors are not just investing in assets—they’re investing in innovation.

#5 More Upside with Global Blockchain Coin Creation

Global Blockchain (TSX: BLOC.V; OTC: BLKCF) is set to not just grant investors exposure to the space, it will provide additional value with its own incubator for new tokens. That’s because it sees a major gap in the token world: New ICOs have teams that are only one-dimensional—they’re developing but not following through in the market. Global Blockchain is planning to pick up the slack here. They won’t just help new blockchain companies build, they’ll help brand and distribute.

This is the next stage in an industry that is crying out for development, and Global Blockchain has a first mover advantage and the experience to increase its chances of getting it right.

Where Wall Street is slow, crypto investing is high-speed. The potential growth of crypto-currency and blockchain and token companies outpaces anything we’ve ever seen, so it’s a game for early-in investment. Until now, that’s been practically impossible because most investors don’t have enough expertise to qualify them.

With an investment company providing investors access to a basket of holdings within the blockchain space, managed by a team of industry early adopters and pioneers, Global Blockchain, listed on the Toronto, Frankfurt and Australian stock exchanges, provides investors with a chance to access a market that could be bigger than any industry because it could affect every industry.

Big money is coming to this industry, and the next investors may be Wall Street hedge funds. After that, possibly ETFs. And then everyone else. Getting ahead of the wave is now possible with (TSX: BLOC.V; OTC: BLKCF) investment and incubator strategy.

https://oilprice.com/Energy/Energy-General/A-Trillion-Dollar-Opportunity-The-Secret-Behind-Bitcoin.html

_________________

Anarcho-Capitalist, AnCaps Forum, Ancapolis, OZschwitz Contraband

“The state calls its own violence law, but that of the individual, crime.”-- Max Stirner

"Remember: Evil exists because good men don't kill the government officials committing it." -- Kurt Hofmann |

|