CovOps

Location : Ether-Sphere Location : Ether-Sphere

Job/hobbies : Irrationality Exterminator

Humor : Über Serious

|  Subject: War Tax Resistance: Hobby Lobby, Bitcoins, and The Peace Tax Fund Subject: War Tax Resistance: Hobby Lobby, Bitcoins, and The Peace Tax Fund  Fri Nov 27, 2015 9:36 pm Fri Nov 27, 2015 9:36 pm | |

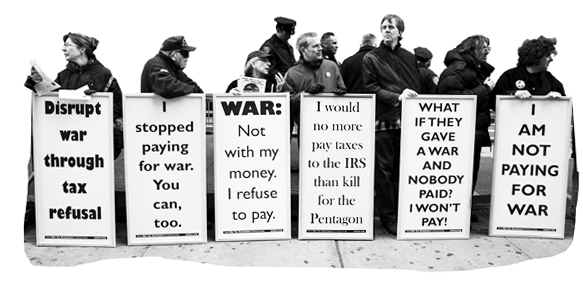

| Back in October, we learned that 90% of the victims who are killed by U.S. drone strikes are innocent civilians just like you and me. Except that we’re not so innocent, right? Because our tax dollars pay for those drones. Sure, the politicians are the ones who sanction these wars; and yes, it is the soldiers who go off and fight the “bad guys” for us; but it is the citizens (“We the People”) who are funding these atrocities. So I guess that means we’re all war criminals with blood on our hands. If this fact is as difficult for you to accept as it is for me, then you probably find yourself asking: what then must we do? What can we do?

I was having a difficult time shaking the ninety-percent statistic from my mind, and then I was reminded of the Hobby Lobby ruling from several years ago. In case you are not familiar with it, this is the ruling which declared that Hobby Lobby – a private business, owned by Christians – did not have to pay for some forms of birth control (which were otherwise covered by the healthcare that was already being provided to their employees by the company) because the owners of Hobby Lobby equate those particular forms of birth control with abortion, and paying for them would go against their religious beliefs.

A little Googling revealed that some activists and authors have already speculated on whether or not pacifists might be able to utilize the Hobby Lobby ruling in a similar way, in order to deflect their taxes from funding war crimes. Clearly there is a technical difference between employee benefits versus taxes, but in principle it is the same idea, and it does seem like the argument could be made. So I sought legal counsel and asked what the likely outcome would be of taking a case like this to court, using the Hobby Lobby ruling as legal precedent. And this is the response I received:

- Quote :

- “If the U.S. had a single-payer healthcare system like Canada, Hobby Lobby never would have happened because the money which is set aside for Canada’s healthcare is pooled together and then drawn from anonymously, as needed. Similarly, our taxes feed into a general pool from which money is taken out by the government when needed, so you would never actually know if your money specifically was being used to fund war crimes. Since you can’t know, you could never sue the government. It would be deemed frivolous, and the case would be thrown out.”

This strikes me as a convenient “get out of jail free” card for those who don’t want to acknowledge the blood which their money represents, usually at the expense of poor brown people who just happen to be in the wrong place at the wrong time.

That response, while frustrating, then led me to the following idea: what would happen if we started using something like Bitcoins to pay our taxes? Bitcoins generate a unique code and they are also trackable. Shouldn’t we then (in theory, at least) be able to track exactly when and where and how our tax money is being used, if we could utilize a similar system? The IRS could (again, in theory) set up their own version of crypto-currency and you would then be able to view your balance online. Each time the government dips into your account, you could receive a digital receipt via text and/or email, telling you exactly what/where/when/why the funds were being used.

When I suggested this idea to the same legal counsel, they completely freaked out: “This is a slippery slope and you would risk opening Pandora’s Box! What’s to stop others from choosing where their taxes would go?” Indeed. And what would be so wrong with giving people that choice? There are a lot of people who currently resent having to pay their taxes, but what would happen if they were suddenly given a say in how those funds were distributed?

Reforming the tax system has been a big part of the conversations at the RNC debates, and it makes me wonder how many of them might also be interested in the possibility of directing and monitoring how their taxes are used. It could start off as a poll to see what people would prefer: when you go to pay your taxes, there could be a checklist of things you do (or do not) want your money going towards. Everyone would have preferences, so let’s see what those numbers look like on a spreadsheet: would the numbers ultimately balance out or would they be horribly skewed? What programs would be overfunded and which would be underfunded? And then let’s talk about alternatives, starting from that point…

I like this idea quite a good bit, and felt that I was on the right track, especially after seeing how freaked out the lawyers were! So I contacted the National War Tax Resistance Coordinating Committee to see what they thought. They were intrigued, but said that it sounded like I was trying to recreate the Peace Tax Fund via Bitcoin. I was not familiar with the Peace Tax Fund, and was thrilled and delighted to discover the following:

- Quote :

- “Congressman John Lewis of Georgia introduced the Religious Freedom Peace Tax Fund bill in the 114th Congress on May 15, 2015. The Bill’s number is H.R. 2377. Currently, there are no cosponsors. This bill, if passed, will extend to U.S. taxpayers the right of conscientious objection to paying for war and preparation for war.”

How the Peace Tax Fund Bill would work:

The Peace Tax Fund Bill would affect the “current military” portion of the U.S. budget. The Peace Tax Fund Bill would amend the Internal Revenue Code to permit taxpayers conscientiously opposed to participating in war to have their income, estate or gift tax payments spent for non-military purposes only. The Bill excuses no taxpayers from paying their full tax liability.

Where the Peace Tax Fund money would go:

The full federal taxes of conscientious objectors would be placed into a special trust fund in the Treasury, called the Religious Freedom Peace Tax Fund. The Treasury would be allowed to spend this money on any governmental program that does not fulfill a military purpose.

Advantages of a Peace Tax Fund:

The Peace Tax Fund Bill is a matter of conscience. While it would not immediately impact the level of military spending, passage of the Bill would have these distinct advantages:

- The Peace Tax Fund Bill would restore freedom of religion as protected in the First Amendment to those taxpayers whose religious or moral convictions forbid participation in war, whether physical or financial. This “first of the freedoms” is the cornerstone of a democratic society.

- Each publication of instructions accompanying income tax forms for 160 million taxpayers would include information about the availability of conscientious objector status. This would be a tremendous educational opportunity. Just as provisions for conscientious objection cause those in the military to weigh their consciences, so too would the Peace Tax Fund.

- The Peace Tax Fund Bill would be a meaningful step towards raising the national consciousness about misplaced military priorities. The level of usage of the Peace Tax Fund would be reported by Congress each year, and would serve as a measure of the nation’s conscience regarding the inhumanity of war.

- It will be a watershed event for religious and civil liberties when a major military power acknowledges its citizens have a just claim to freedom of conscience which has been denied. In addition, it will greatly facilitate the passage of similar legislation in other countries.

- The Peace Tax Fund Bill is a win-win proposition. Conscientious objectors would be guaranteed the current military percentage of their income tax would be used only for life-affirming purposes. The government would receive more revenue from increased participation in the payment of income taxes and would spend less on the cost of forced collections.

Conscientious objection to killing in war holds a historically and legally unique place in our nation. It is like no other issue. The plight of those who object to military taxes on the basis of deeply held and universally recognized teachings is on a higher moral plane than objections based on mere political, social or economic preference. As such the Peace Tax Fund Bill would not open the door to other exceptions. I am concerned, though, about the final line of that description: “As such the Peace Tax Fund Bill would not open the door to other exceptions.” I don’t know if they can make that claim with complete assurance. Because what happens, say, when a group of Christians decide that they don’t want their taxes to pay for Planned Parenthood? From their point of view, it is also a moral and/or conscientious objection, and they would also argue that their money was being used to murder innocents. Whether or not you agree with their argument (and just for the record, I do not) it still seems like it might be potentially hypocritical to deny one conscientious objection while allowing for the other…

Besides that one concern, I think it is an absolutely brilliant idea and quite the worthwhile cause to take up. If you agree, please spread the word about this bill far and wide! They also have options on the website for contacting your congressman and local editors, so please feel free to take advantage and help get the word out. I still like the Bitcoin idea, though freely admit that the PTF would probably be a much more efficient route for pacifists…and probably a lot easier to implement, in the long-run. That being said, I suspect that the Bitcoin idea might also do quite well by appealing to a larger bipartisan audience. Who knows what the potential impact might be on how we go about discussing/debating the issue of paying taxes in this country?

And for some final insight into these issues, the NWTRCC also provided me with this great talk by Peter Goldberger, in which he discusses the history of war tax resistance from a legal framework before speculating on the potential implications of the Hobby Lobby ruling, as well as the Peace Tax Fund. It’s a fascinating talk, and worth watching if you have the time. (They also shared a transcript of his speech, as well as a recent analysis.)

http://disinfo.com/2015/11/war-tax-resistance-hobby-lobby-bitcoins-peace-tax-fund/ |

|