RR Phantom

Location : Wasted Space

Job/hobbies : Cayman Islands Actuary

|  Subject: Lacy Hunt Blasts MMT, Fears Hyperinflation If Implemented Subject: Lacy Hunt Blasts MMT, Fears Hyperinflation If Implemented  Sun Apr 14, 2019 5:42 pm Sun Apr 14, 2019 5:42 pm | |

| In the Hoisington First Quarter Review, Lacy Hunt blasts MMT as "self-perpetuating" inflation.

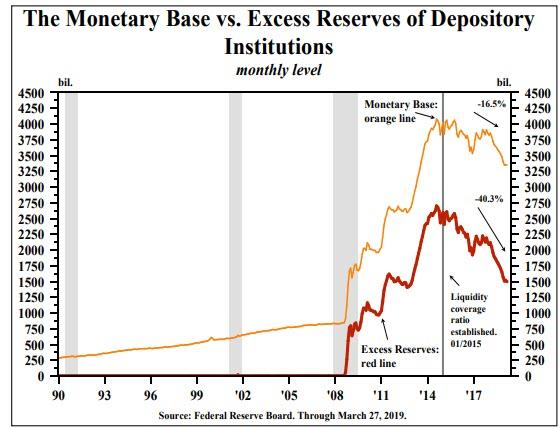

Under existing statutes, Fed liabilities, which they can create without limits, are not permitted to be used to pay U.S. government expenditures. As such, the Fed’s liabilities are not legal tender. They can only purchase a limited class of assets, such as U.S. Treasury and federal agency securities, from the banks, who in turn hold the proceeds from this sale in a reserve account at one of the Federal Reserve banks. There is currently, however, a real live proposal to make the Fed’s liabilities legal tender so that the Fed can directly fund the expenditures of the federal government – this is MMT – and it would require a change in law, i.e. a rewrite of the Federal Reserve Act.

This is not a theoretical exercise. Harvard Professor Kenneth Rogoff, writing in ProjectSyndicate.org (March 4, 2019), states “A number of leading U.S. progressives, who may well be in power after the 2020 elections, advocate using the Fed’s balance sheet as a cash cow to fund expansive new social programs, especially in view of current low inflation and interest rates.” How would MMT be implemented and what would be the economic implications? The process would be something like this: The Treasury would issue zero maturity and zero interest rate liabilities to the Fed, who in turn, would increase the Treasury’s balances at the Federal Reserve Banks. The Treasury, in turn, could spend these deposits directly to pay for programs, personnel, etc. Thus, the Fed, which is part of the government, would be funding its parent with a worthless IOU. In historical cases of money printing, the countries were not the reserve currency of the world, as the U.S. is today. Thus, the entire global system could be destabilized in very short order if this were to occur.

There would be no real increase in services or money since very little time would lapse before people realized increasing inflation was not increasing real purchasing power. If the government responded by issuing more central bank legal tender, the inflationary process would become self-perpetuating, and as was the case in numerous historical instances this would lead to hyper-inflation. Moreover, the central bank would have no capability of reducing the money supply. All they could offer would be the zero maturity, zero interest liabilities of the government, but there would be no buyers. This would mean that hyper-inflation would be difficult to stop.

https://www.zerohedge.com/news/2019-04-14/lacy-hunt-blasts-mmt-fears-hyperinflation-if-implemented |

|